By: Dan Hueber –

While I am not sure why it would come as a surprise to anyone, import/export data from China appears to have cast a negative shadow over the grain and soy markets as we begin the week and particularly for the latter. During the month of December, the total quantity of beans unloaded at Chinese ports tallied 5.72 MMT, which is right at 40% beneath the quantity imported a year ago. For the year as a whole, that nation imported 88.03 MMT of beans, which would be down 7.9% from the previous year and marks the first time exports have been lower year over year since 2011. The news was not only negative for our commodity trade, but it was none too positive for the Chinese and other equity markets either as it was reported that total imports into that nation were down 7.6% for the month and exports down 4.4%, the most in two years. When it came specifically to trade with the U.S., exports were down 3.5% with imports down a whopping 36%. Interestingly enough, for the year China still exported 10% more than in 2017 but it is obvious that the trade war is extracting a toll and so should come as no surprise that they are in a negotiating mood.

Several more consulting firms have been cutting their estimates for the Brazilian bean crop and it would appear the race to the bottom has begun. Safras & Mercado took its estimate down to 115.7 MMT, the National Agricultural Society is at 114 MMT, Agrivest Commodities is looking for 113.1 and Aprosoja is pointing for something between 110 and 115. Dr. Cordonnier left his estimate unchanged this week at 116 MMT but maintains a lower bias for the future.

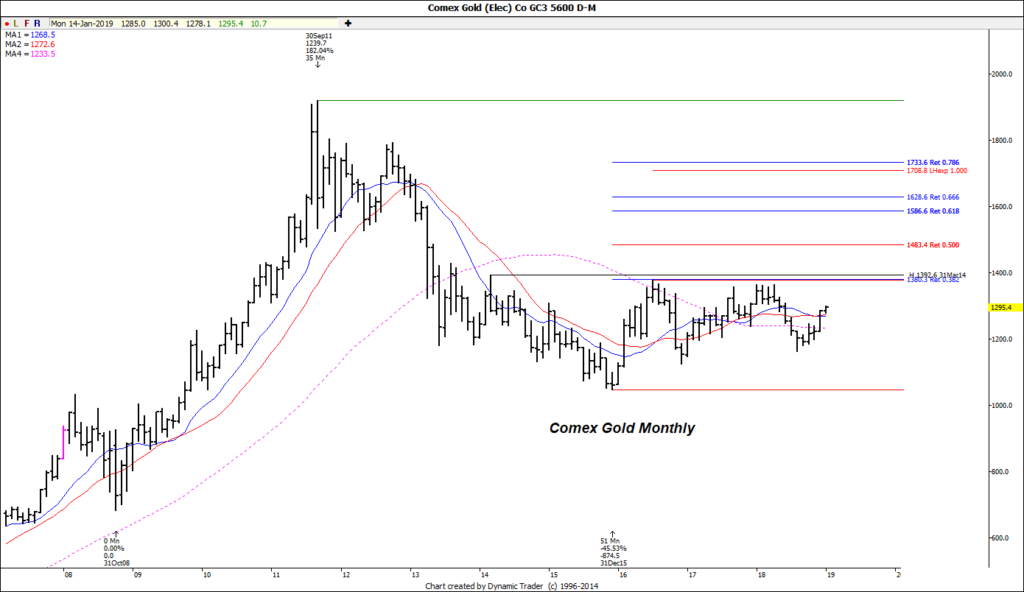

Looking at the macros, equity markets are under pressure, energies are weak and the dollar is flat to lower. Do note that gold has begun on a positive step and is trying to extend what has now been a four-month advance. No doubt the break in equity markets and dollar have redirected some money back into this market but take note that as with so many commodities, we have been in a large sideways pattern over the past four years and currently are headed for the major flat top that has been stopping us during that time. It would seem that is only a matter of time before one commodity sector or another pushes through the upper limits that have developed and once that happens, other will quickly follow suit.